VAT Exemption

Incontinence products

All incontinence products such as incontinence pads and pants, bed pads, and urinals qualify for VAT exemption automatically if ordering for personal and not business use. If you order a quantity over a certain threshold you may be asked to complete a simple VAT exemption declaration to confirm the products are for personal and not business use. Prices on these items are now listed as EX. VAT only. These items will be identified by a green VAT Exempt label.

Orders that exceed the following thresholds will require a VAT Declaration(automatically triggered in the checkout):

- More than 200 disposable pads, pull-ups, all in ones or bed pads.

- More than 50 washable pads including washable pants and bed pads.

- More than 5 collecting devices such as urinals and bed pans.

- More than 10 pairs of waterproof or leakproof underwear.

Healthcare products

Some of our health and personal care items are also classified VAT exempt if you or the users are eligible due to long-term medical impairments when bought for personal not business use. These items will be identified by a green VAT Exemption Available label and will require a similar VAT Relief declaration at the checkout. These items will have both INC. VAT and EX. VAT prices.

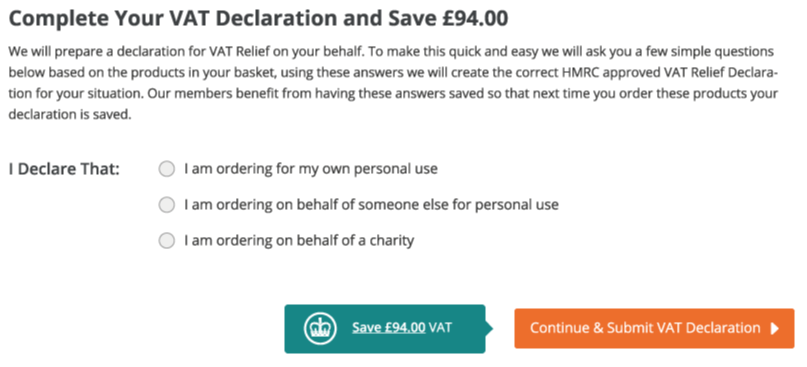

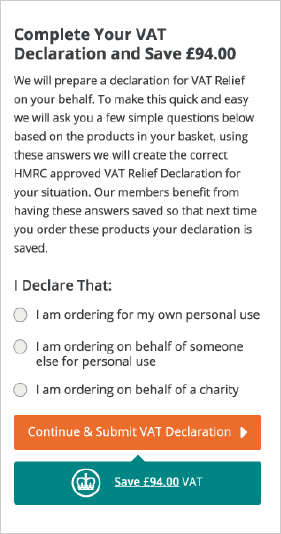

How to Claim

Products that are VAT exempt will be clearly marked as such on the website. During the checkout process, before payment and if required, you will be asked to complete our VAT exemption declaration. The name and address of the user will be required. If you are purchasing the goods for a registered charity, then we will require your charity number.

Important Information

If you or the end-user suffers from a long-term medical impairment, then it is very likely you will be eligible. You do not need to be registered as disabled in order to qualify for VAT relief. If you require further clarification, it might be worth talking to your local tax office on 0300 123 1073. Section 39.2 of the VAT Act 1983 provides for severe penalties for anyone who makes use of a document that they know to be false for the purposes of obtaining VAT relief. The completed VAT exemption declaration form is retained for presentation to the VAT office only, and will not be used for any other purposes.